how fast does an auto loan build credit

In this article well answer the question Does financing a car build credit and provide some additional. A large purchase might affect your credit utilization ratiothe amount of available credit you have divided by your total available creditwhich in turn affects your credit score.

Can You Transfer A Car Loan To Someone Else Valley Auto Loans Car Loans Car Finance Car Loan Calculator

This is also an opportunity to check your credit reports for errors which could bring your credit scores down.

. 100 5000 Personal Loans from King of Kash Borrowers are always welcome. Federal VA FHA Rural Development WHEDA Investment Property and Construction loans. And one of the best ways to generate passive income is.

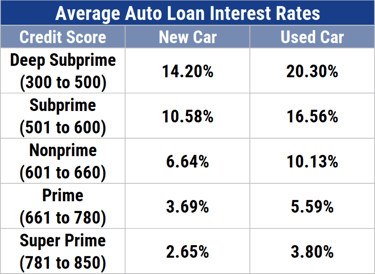

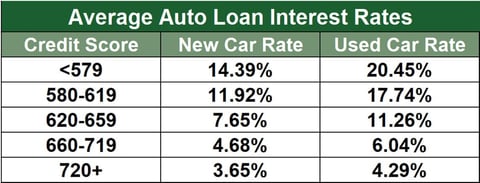

3 The following loan programs are not eligible for the closing cost credit. The table below shows the average auto loan rate for new- and used-car loans based on credit scores according to Experian data from the second quarter of 2020. Auto loan refinancing is an option for most buyers.

Build refinancing into your plans. A payday loan is a short term loan product that must be repaid within one week to as many as. Other services such as credit repair may cost you up to thousands and only help remove inaccuracies from your credit report.

This service is completely free and can boost your credit score fast by using your own positive payment history. Credit history from day 1 at major credit bureaus get 25 when you build your credit score to a 700 credit score within 12 months of use. They may even offer an alternative auto loan solution for your new car at a reduced rate.

Buying a car does help your credit but never buy a car just to raise your credit. An auto loan from InTouch Credit Union is a fast and convenient way to lock in an affordable payment. These offers do not represent all available deposit investment loan or credit products.

One of the key ways to build wealth fast and over the long term is to earn passive income. A payday loan is the easiest unsecured personal loan for someone with a bad credit score to get. Max 72-month payment term.

When it comes to building credit its easy to get overly focused on ways to raise your credit scores fast. The amount of money you can borrow depends entirely on the type of loan you are applying for the purpose of the financing and your individual financial and credit situation. You may be able to fund your loan today if today is a banking business day.

The easiest secured loan someone with a bad credit score can get is likely a pawnshop loan. And what to do if you cant wait. In the eyes of the law both the cosigner and student are responsible for any missed payments or late payments over the life of the loan which can impact both credit reports.

The loan amount is based on an evaluation of the applicants credit and payment history income and length of employment. If you have an excellent credit score 750 you can usually get the best financing rates right from the dealership. Fixed rates range from 899 APR to 1699 APR.

Ive literally never said this before in all my time at Money Under 30 but in this case you really dont need to shop around for the best rates. Before signing any documents make sure that you have contacted your original auto loan lender to inform them of your decision to trade-in. At LendingTree we want to help you monitor and improve your credit.

Thats because neither of these loans requires a credit check. Promotional rate applies to new or used 2019-2021 model year vehicles with a loan to value of 90 or less 36-month term and a minimum credit score of 730 FICO Auto Score 9. Here are a few donts to keep in mind.

2 Personal Line of Credit. Both the cosigner and student can build their credit with repayment of the loan. There are also ways to use rent phone and utility payments to build credit.

Typically an unsecured personal loan is between 500 and 15000. If you charged 2000 to your credit card to buy a mattress the purchase might represent 20 utilization of your 10000 credit limit. However this can still cause a small reduction in credit score.

We specialize in poor credit car loans but have multiple options available for everyone and are available 247 365 from our US-based call center to answer any questions and help get you behind the wheel. No annual fee no foreign transaction fees no minimum security deposit. You may be able to fund your loan today if today is a banking business day.

By John Csiszar Feb 15. The truth is that building credit takes time. How to build your credit before getting a new car loan It will take time but heres what to do for a better shot at a lower car loan rate.

Car loan rates by credit score. The interest rate reduction. If you want to build credit without a credit card you might try a credit-builder loan secured loan or co-signed loan.

Fast 2-minute eligibility check. Variable rates range from 949 APR to 1574 APR. Offer valid on home purchase applications submitted from January 1 2021 through December 31 2021 where the loans interest rate is locked by December 31 2021.

Our credit experts work with you on an individual basis to find the best auto loan options tailored to your credit income and needs. To apply for a 203b loan you need a credit score of at least 580 for a 35 down payment or 500579 for a 10 down payment. It can also help those with poor or limited credit situations.

Whether you know how much you want to borrow but need help finding the best payment option or want to use the application process to find out what you qualify for InTouch can help you get the answers you want. In short buying a car can be a good way to build your credit score over the life of the loan but its more of a long-term credit building strategy. On a loan amount of 15000 with an APR of 189 and a 36-month.

Shopping for auto loan rates within a 14-day period will ensure that multiple inquiries are counted as only one inquiry or excluded entirely by some scoring systems according to the credit bureau Experian. This is because the dealer themselves will serve as a broker and show those with good credit the best options. No matter your reason for needing extra cash you can have the money you need in no time with.

When you want money for anniversaries vacations school loans OR when you need money for car repairs medical expenses or other emergencies King of Kash is the Easy Loan Store for all your needs. You can refinance right away if for example. So take a step back and make sure your strategy doesnt do more harm than good.

This is the amount you will have to pay out of pocket to the original auto loan lender before you can trade the car in. With LendingTree you get Best in class credit tools. Get unsecured in as little as 4 months.

Unlike conventional mortgage loans the down payment can come from your savings gift funds or government programs. Each month well give you your credit score for free in addition to evaluating your credit score and current debt to see if there is any room for savings. Pitfalls to avoid when working on your credit scores.

10 Ways To Build Wealth Fast But it will still take some time and effort. 9 Your loan officer will provide you with guidance on what documentation is needed to help expedite the approval process. Accepting a loan offer may cause another small score dip.

Why Doesn T My Auto Loan Show Up On My Credit Report Experian

/best-auto-loan-rates-4173489_FINAL-84fa7faff6244117a47e6641978a86dc.png)

Best Auto Loan Rates Of February 2022

Does Financing A Car Build Credit

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Consolidate Credit Card Debt

13 Instant Approval Auto Loans For Bad Credit 2022

How To Get A Car Loan With No Credit History Lendingtree

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Credit Repair

17 Bad Credit Car Loans 2022 Badcredit Org

Auto Loan Payment Calculator Estimate Your Payments Forbes Advisor